Business Insurance in and around La Place

One of the top small business insurance companies in La Place, and beyond.

Insure your business, intentionally

Help Prepare Your Business For The Unexpected.

Preparation is key for when an accident happens on your business's property like an employee getting hurt.

One of the top small business insurance companies in La Place, and beyond.

Insure your business, intentionally

Keep Your Business Secure

Planning is essential for every business. Since even your brightest plans can't predict consumer demand or product availability. In business, you can be certain of one thing: nothing is certain. That’s why it makes good sense to plan for uncertainty with a State Farm small business policy. Business insurance covers your business from all kinds of mishaps and troubles.. It protects your hard work with coverage like business continuity plans and extra liability. Fantastic coverage like this is why La Place business owners choose State Farm insurance. State Farm agent Emily St. Pierre can help design a policy for the level of coverage you have in mind. If troubles find you, Emily St. Pierre can be there to help you file your claim and help your business life go right again.

Do what's right for your business, your employees, and your customers by calling or emailing State Farm agent Emily St. Pierre today to research your business insurance options!

Simple Insights®

Ways to help set financial goals

Ways to help set financial goals

As a business owner, your financial goals should be split into two worlds: one set for your business and another for your personal life.

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?

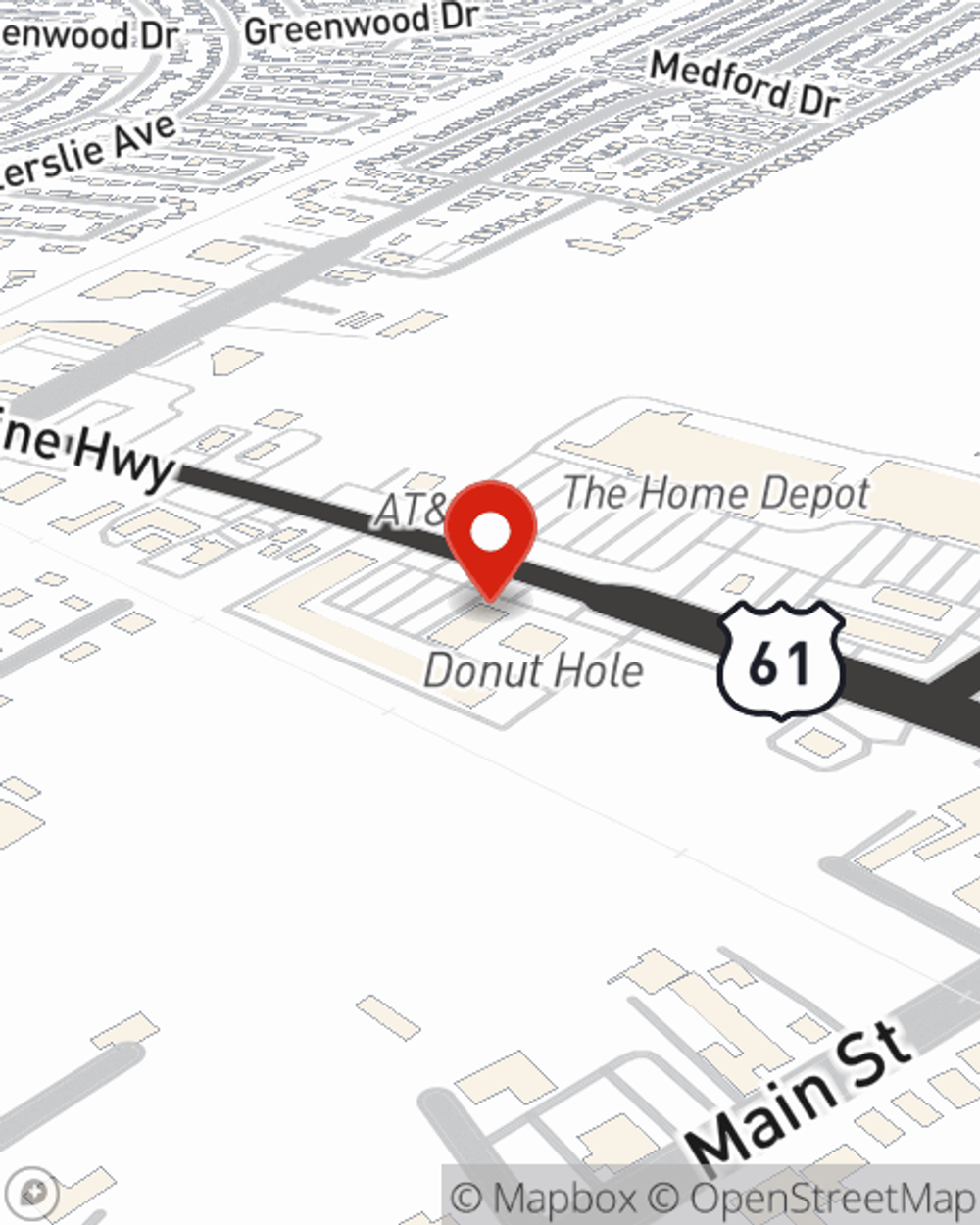

Emily St. Pierre

State Farm® Insurance AgentSimple Insights®

Ways to help set financial goals

Ways to help set financial goals

As a business owner, your financial goals should be split into two worlds: one set for your business and another for your personal life.

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?